Monthly possible subject to approval Quarterly 10 days from the end of the month and by end of the month for the last month of the financial year. Those companies that are achieving annual turnover above RM5 million the filing frequency will be increased to monthly.

Qrmp Scheme Quarterly Return Filing Monthly Payment Of Taxes

GST returns must be submitted to the GST office not later than the last day of the following month after the end of the taxable period.

. The GST Council recommended the Quarterly Return Filing and Monthly Payment of Taxes or QRMP scheme under GST in its 42nd meeting held on 5th October 2020 as a business facilitation measure. Supplies made between 1 June and 1 September 2018 are liable to zero GST and should be reported as normal in the quarterly or monthly GST return The final GST return should be filed by 1 September 2018 GST audits and reviews will continue to 2019. That means any GST return is due within 30 days of the end of the reporting period.

Businesses have to charge and collect GST on all taxable goods and services supplied to the consumers. One month after the end of the tax period for quarterly returns. The Goods and Services Tax GST is an abolished value-added tax in Malaysia.

It was introduced to reduce the compliance burdens and promote ease-of-doing-business EODB. Malaysia has started imposing a 6 service tax on imported digital services effective from 1 January 2020. Payment must be made on or before the last day of the month following the taxable period.

The sales tax is only levied on the level of the producer or manufacturer while the service tax is imposed on all customers who use tax services. 4 The standard rate of Sales Tax in Malaysia is 10. Businesses with annual turnover above RM5 million the frequency of filing is monthly.

Option to choose between Self Assessment Method Fixed Sum Method monthly depending upon fund availability. GST invoices in Malaysia In order to comply with tax laws you should include the following information on your invoices to customers in Malaysia. Your business name and address Your business VAT number Invoice date.

It applies to most goods. Periodicity of filing GST return will be deemed to be monthly for all taxpayers unless quarterly filing of the return is opted for Taxpayer re gistered under Regular Scheme For business registered under the regular scheme the type of GST Return and the frequency of filing it depends on the turnover of the business. The SST rates are less transparent than the standard 6.

Businesses are allowed to claim whatever amount of GST paid on the business inputs by offsetting against the output tax. What is the impact of the change of gst to sst in malaysia. Creating monthly or quarterly gst return 03 automatically.

GST is levied on most transactions in the production process but is refunded with exception of Blocked Input Tax to all parties in the chain of production other than the final consumer. The excess amount of output tax shall be remitted to the. The standard goods and services tax GST in Malaysia is sales and service tax SST of 10.

Businesses that are registered under gst have to file the gst returns monthly quarterly and annually based on the. The GST also known as value added tax VAT in some countries is not a new concept of taxation as other countries in the region introduced GSTVAT years ago. The existing standard rate for GST effective from 1 April 2015 is 6.

This scheme became effective from 1st January 2021. Where annual taxable supplies are between 1500000 and 6000000 GSTHST is required to be filed quarterly and where taxable supplies are 1500000 or less an annual reporting period would be permitted. How much is GST in Malaysia.

Featured PwC Malaysia publications. Returns under Monthly Scheme. For annual revenue not exceeding RM5 million the taxable period is quarterly and for annual revenue exceeding RM5 million the taxable period is monthly.

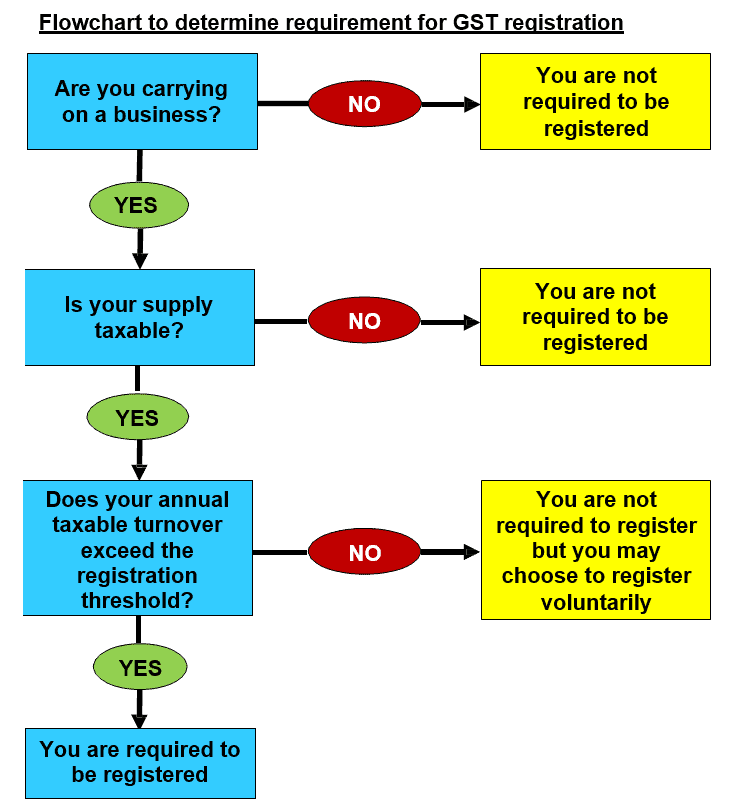

The deadline for GST filing GST Returns and payment of GST is the last day of the month following the taxable period. SST refers to Sales and Service Tax. Only businesses registered under GST can charge and collect GST.

Self Assessed Payment on monthly basis. The introduction of the six percent GST in Malaysia from April 1 2015 will bring forth radical changes to the Malaysian tax landscape. For GST is charged on all taxable supplies of goods and services in Malaysia except those specifically exempted.

Goods and Services Tax GST is a broad-based consumption tax levied on the import of goods and services as well as nearly all supplies of goods and services in Malaysia except for zero-rated exempt supplies. TAXABLE PERIOD PAYMENT TIMING Taxable Period refers to the regular period where GST is computed. Actually existing goods and service tax gst system is replaced.

Malaysias GST was administered by the Royal Malaysian Customs Department. What does GST mean for a Malaysia company. Below is a summary of the points for taxpayers to consider during the transition period.

Taxable period is a regular interval period where a taxable person is liable to account and pay to the government his GST liability. Goods and Services Tax GST is a multi-stage tax on domestic consumption. However it was started way before SST in April 2015 and was governed by the Goods and Services Tax Act 2014.

GST Return filing compliance burden for Tax Payer. As for the frequency it depends on the annual turnover of the company. GST is also chargeable on the importation of goods and.

Compliance cost for payment to accountant tax professional. Companies are required to pay tax by monthly instalments based on the estimates submitted commencing from the second month of the companys basis period. Collecting GST in Malaysia Once youre registered for taxes youre expected to charge 6 GST on every sale to a Malaysian resident.

Filing can be done either by post or online. For annual turnover below RM5 million the frequency of filing is quarterly. Management of Working Capital.

The GST lasted for three years and was later on replaced and transited to the SST policy from 1 st September 2018. In some countries GST is known as the Value Added Tax VAT. Tax Leader PwC Malaysia 60 3 2173 1469.

The standard taxable period is on quarterly basis. 3 The standard rate of 6 of Service Tax applies to most taxable services except for taxable services relating to credit card or charge card services. Monthly for payment purpose quarterly annually Monthly bi-monthly six-monthly Monthly VAT declaration quarterly return Quarterly.

Requirement of gst registration and.

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

Gst Training Accounting For Gst Malaysia Jason Tan Associates

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

Do I Need To Register For Gst Goods And Services Tax In Malaysia

Economic Report 2015 2016 Gst Collection To Increase To Rm39 Bil In 2016 The Edge Markets

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

Sales Tax And Service Tax 2018 Sage 300 Malaysia

Ws Business Services Accounting Bookkeeping Gst Services Malaysia 做账服务we Are Accounting Service Provider For Home Based Enterprises Sole Proprietor Partnership And Small Medium Offices Sdn Bhd In Malaysia Our Services Include

Do I Need To Register For Gst Goods And Services Tax In Malaysia

Due Dates For Gst Returns Types Of Gst Returns Ebizfiling

Basic Concepts Of Gst Goods Services Tax Goods Services Tax Gst Malaysia Nbc Group

Goods And Services Tax Gst In Malaysia 3e Accounting

Gst Malaysia Section 1 What Is Gst Klm Group Accounting Company Secretarial Taxation Audit Kuala Lumpur

Gst Training Accounting For Gst Malaysia Jason Tan Associates